The importance of accounting software is undeniable for e-commerce businesses to transition from traditional to advanced accounting methods.

For example, it can help them centralize different business processes with real-time insights.

But here’s the thing – the advantages of accounting software in an e-commerce landscape are undeniable. But it also has its fair share of flaws.

Let’s go through the pros and cons of accounting software for e-commerce businesses so you can use it to enhance your business.

- Accounting software helps businesses switch from traditional accounting to modern accounting methods.

- By using accounting software, you can track your sales figures and ensure sales tax compliance.

- Accounting software can pose cybersecurity risks. This is why it is important to purchase top-quality accounting software

- You can use e-commerce accounting software to manage your inventory levels.

Understanding The Role Of Accounting Software For E-Commerce Businesses

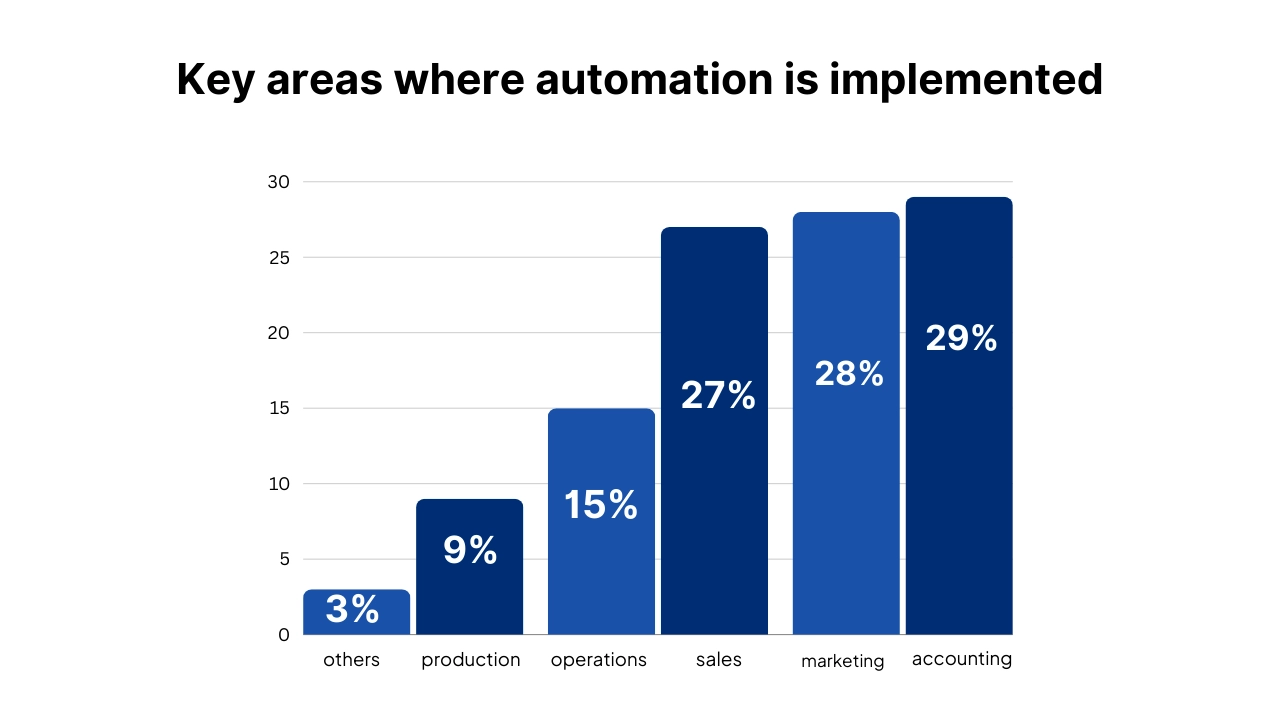

First things first, accounting software cut down on manual operations by automating data entry and other time-consuming tasks.

Look at QuickBooks Online. This tool helps you save 8 hours per week so that you can use that time to focus on strategizing your business.

You can use this tool to increase your productivity and improve overall efficiency.

It can help you automate day-to-day tasks and lift some of the burden from your staff.

You can use accounting software to bring structure to your business; handle your finances, conduct regular audits, and identify areas of improvement and growth.

The reason why e-commerce is heavily dependent on accounting software is because of the real-time insights it provides you with.

It wouldn’t be inaccurate to say that accounting software can be an asset to your company as it can help you become more proactive and resolve matters as soon as they arise.

Accounting Software for E-Commerce – The Benefits

The e-commerce industry is always changing.

To stay relevant, you must incorporate advanced tools and train your employees accordingly.

Using accounting software to survive in a fast-growing market can be a smart business move.

Let’s look at the top advantages of accounting software. They can help you visualize their impact on your business.

1. Manage Business Transactions

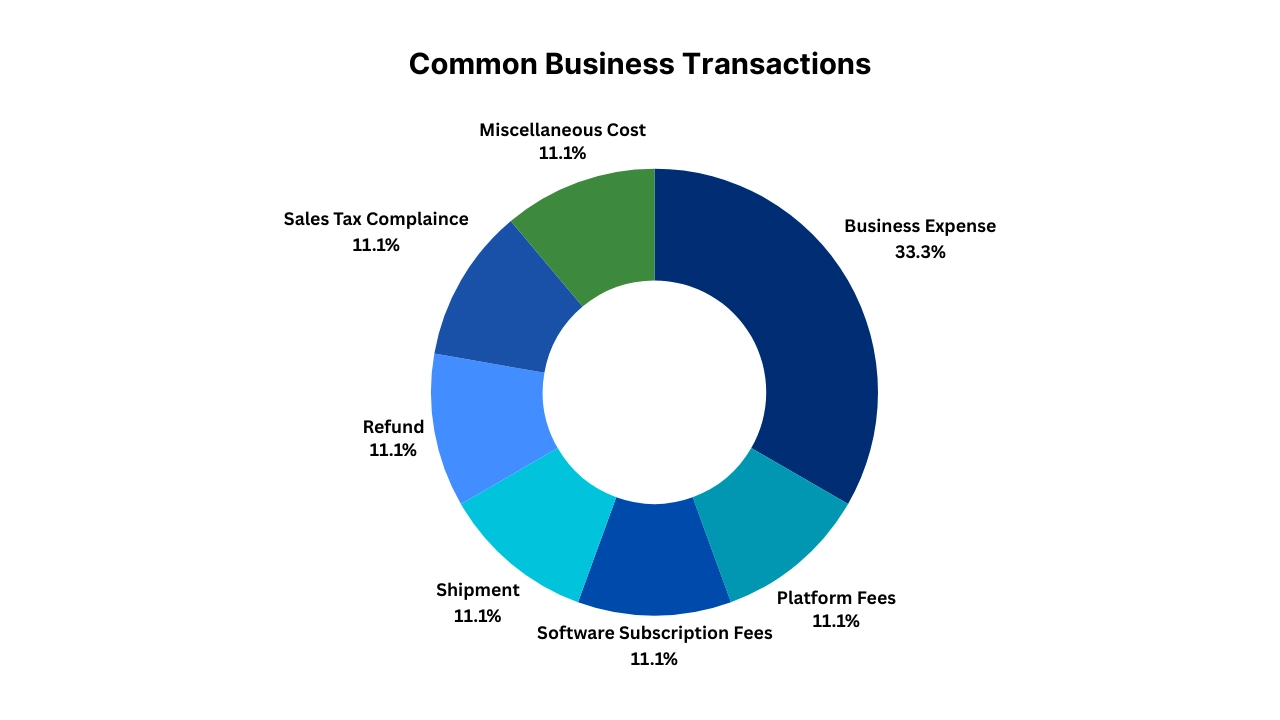

Accounting software is commonly used to manage financial transactions specific to e-commerce businesses.

E-commerce businesses have diverse sales channels, making cash flow tracking slightly more challenging.

In fact, most business owners struggle with the calculation of e-commerce revenue

You have business expenses, platform fees, sales tax compliance, refunds, shipment, and other miscellaneous costs to consider.

It’s common to make mistakes by manually tracking your finances. Think about how mentally draining and time-consuming it will be to categorize all your transactions.

It would take you hours to categorize your day-to-day financial transactions.

This is where you will realize the importance of accounting software.

The right accounting software will not only help you record but also categorize your transactions.

It will provide you with real-time information on your dashboard, helping you make quick decisions.

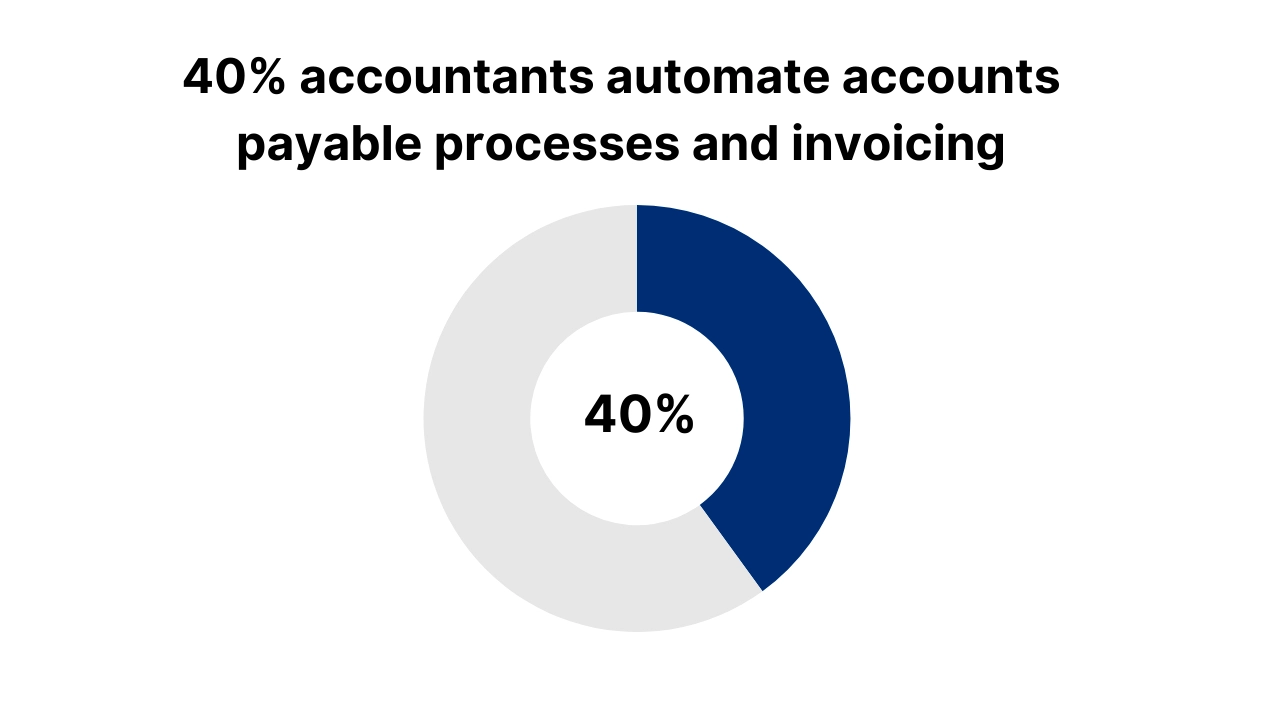

Of course, its integration reduces errors, automates invoice generation, and seamlessly reconciles bank statements.

Accounting software can be a huge stress relief when you’re tracking payment status or evaluating your financial performance.

You no longer have to wait for hours for your accountant to send you a detailed analysis of your business’s financial health.

An accounting system makes everything easy and accessible.

2. It Enhances Data Accuracy

Data accuracy plays a key role in driving your business forward.

Manual data entry is prone to human error. You could enter the wrong data or make calculations based on incomplete information.

While the problem is small, it leads to costly mistakes – a cost a small e-commerce company cannot bear.

3. Automatically Generate Financial Reports

The role of accurate information cannot be undermined in decision-making. When you have accounting software, you can reduce the chances of errors and automate the entire process.

This way, you don’t have to spend hours in manual data entry or be hesitant to trust the numbers.

Therefore, using accounting software can help you maintain your finances and ensure you stay on track with your budget.

Furthermore, this practice allows you to make decisions necessary for propelling your business forward.

Some of the questions they help you answer are as follows:

- Am I making enough money?

- Is the business ready to scale?

- How much revenue did I make in the last quarter?

- Do I have enough retained earnings?

- How much dividends can we pay?

- Is my business profiting?

- Should I cut down on cost?

- Am I sticking to the budget?

- How much can I save through tax deductions?

From income statements to your balance sheet, an accounting system allows you to master your financial statements.

4. It Simplifies Tax Compliance

Tax compliance is literally a make-or-break aspect of any e-commerce business.

The role of accounting software is significant here – it allows you to extract accurate and detailed versions of your financial transactions.

Next, it can automate the sales tax calculation and prepare you for filing tax returns efficiently.

This way, you can easily avoid paying hefty penalties from your hard-earned money.

5. Take Decisions Based on Real-Time Insights

E-commerce transactions are complicated so it can be a huge advantage to have a visual for tracking the real-time impact of a transaction on your business.

Some of the numbers you can track on your dashboard include:

- Sales figures

- Customer behavior

- Inventory levels

Having access to this information can truly empower you as you can identify gaps as well as opportunities and the latest trends.

When you have up-to-date data, you inculcate transparency and visibility across business units, keeping every department in a loop.

Real-time insights can be game-changing for your business, and for that, you need accounting software tailored to your business needs.

6. Scale Your Business

Spreadsheets can be used for basic bookkeeping, especially during the initial stages of your e-commerce business.

But once your business picks up pace and the orders start flooding, using an accounting system will become necessary.

Accounting software can help you scale your business and upgrade when the time is right.

Instead of becoming a hindrance, it will give you access to features to adjust your new accounting requirements.

While it may be easy to stick to basics, it may not be enough to paddle your business forward or adapt to its changing needs.

E-Commerce Accounting Software – The Hidden Challenges

BUT, there’s also a downside to accounting software.

Therefore, before you leap, manage expectations by learning the disadvantages of an accounting system.

1. It Is A Learning Curve

While using spreadsheets to handle your books may be easy when starting out, you will notice its limitations once the data becomes complicated.

This is when you’ll see the importance of accounting software – a tool that automatically generates invoices, transfers data, and extracts financial data.

But here’s the thing – switching from manual spreadsheets to accounting software will be a learning curve for you, especially if you don’t have an accounting background.

Many people have highlighted that the language used in accounting software is too difficult for the layman to understand.

And this can be a challenge when your employees step in.

They could struggle to adopt jargon, making it your job to supervise and conduct proper training.

Of course, that means a temporary setback or decrease in productivity in your e-commerce company.

2. Look Into The Security Aspect

While cloud-based accounting is revolutionary, it can expose you to cybersecurity risks.

Adapting to the changing corporate requirements, this software allows employees to access data remotely.

However, this can be a problem should your business fall prey to hacking. Hackers could temper your data or use it to get a ransom.

Choose a top accounting software that prioritizes your security. It should have a robust security system to protect your data from cybersecurity threats.

3. It Can Be Expensive

While it is true that accounting software helps you reduce operating costs and boost your revenue, its initial administrative costs are significant enough for you to think twice.

This is especially true if you’re running a small business.

You should understand that accounting software helps businesses in the long run, but until then you have to bear all relevant costs of implementing it.

Administrative costs include subscription fees, purchasing fees, equipment, and technical support.

4. It Makes You Dependant On The Internet

Cloud-based accounting software relies heavily on the Internet. This means it requires a strong internet connection to function.

So in case there’s a power outage or your internet connection becomes unstable, the accounting software will experience disruption.

This is an important aspect to consider when you’re planning to invest in accounting software.

You don’t want to disturb business processes simply because the software works with an internet connection.

It may delay your operations or create inefficiencies during the power outage.

Quick Tips For Making The Most Of An Accounting Software

Accounting software transforms your business by increasing efficiency and improving productivity.

While it has both pros and cons, it is up to you to leverage the best features and make the most out of them.

Here’s how you can do that:

1. Use It To Forecast Budgets And Marketing Trends

While beginner-level subscriptions may not offer this feature, a good accounting tool will have features to enhance budget and forecasting to help you analyze different situations and their impact on your business.

For example, you can use this feature to estimate where you’re going over budget.

It will control your spending and help you allocate that money to areas where it will be more useful.

2. Evaluate Your Sales Patterns

There are so many ways of looking at your sales data.

Accounting software helps you understand what your business is doing when everything is quiet.

It will help you see how your customers interact with your business and what products are more in demand than others.

This crucial information helps you develop effective marketing strategies and boost your sales.

Improve The Financial Health Of Your Business With Ledger Labs

Accounting software is a transformative tool for your e-commerce business.

While it is a learning curve for someone with no accounting background, it can help you manage your finances, providing real-time insights and improving overall workflow.

Therefore, before purchasing accounting software, weigh its pros and cons and evaluate how it can support your business.

And this is where Ledger Labs comes in.

We’re a bookkeeping and accounting service that has been helping e-commerce businesses for more than 12 years now.

We strive for excellence and have the right experience to help you do accounting for e-commerce right.

We have all the answers you’re looking for.

Book an appointment now and let us help you take your business to the next level.