You Deserve More Than a Monthly Report and a Generic Recommendation

Most virtual CFO services provide a monthly PDF, a brief call summarizing numbers you could read yourself, and generic advice that applies to any business. You often finish the call with more questions and no real changes. That’s not what we do at Ledger Labs. Here’s what actually sets us apart:

More Than Just Number Crunching

Your traditional accountant records transactions and files taxes but is that enough? Well, not always! At Ledger Labs, we do much more beyond this. We analyze your cash flow, optimize expenses, and create financial strategies tailored to your business. Instead of just looking at past numbers, we help you make smarter decisions for the future.

Automation That Saves You Time

Manually tracking finances? Waiting days for reports? That’s outdated. We use AI-powered automation and real-time reporting to eliminate errors and give you instant access to financial insights. No more waiting for your accountant to respond your numbers are always updated and available when you need them.

Expert Financial Guidance Without the Cost

Hiring a full-time accountant or CFO can be expensive. With Ledger Labs, you get high-level financial expertise at a fraction of the cost. We scale with your business, providing exactly what you need whether it’s budgeting, forecasting, or tax planning without the overhead of an in-house team.

Growth-Focused, Not Just Compliance-Focused

Most accountants ensure you’re compliant; we ensure you’re profitable. Beyond tax filings and bookkeeping, we help you plan for growth, improve cash flow, and maximize profitability. Think of us as your financial partner, guiding you toward smarter, faster, and more profitable decisions.

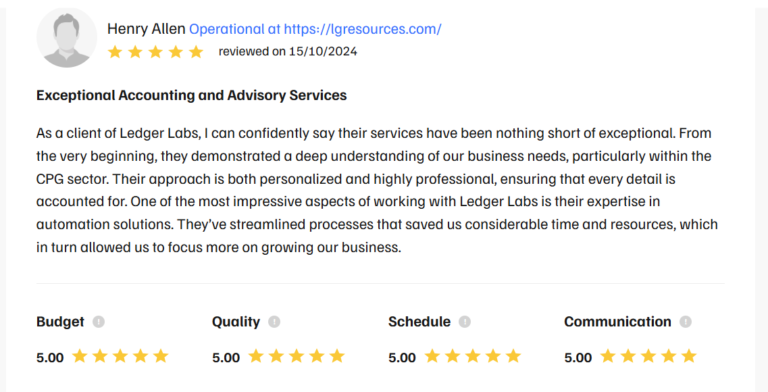

My main problem always has been to know my accurate profits & this is precisely what Ledger Labs helped me with. They went through my entire supply chain costs, my monthly operational expenses, and COGS and got me the correct costing of my goods and the cost of running the business. Now I know how much I need to sell & at what price I should sell it to be profitable.

Ariel Robinson CEO & Founder