Have you ever wondered how businesses monitor their debt repayments? This is where the concept of “cash flow to creditors” drives into the frame.

Cash Flow is the total amount of money that is transferred in and out of a business, gradually affecting its liquidity, flexibility, and financial well-being.

Now, as you can see, cash flow to creditors stems from the foundational idea of cash flow. It is, in fact, an incredibly important metric that shows us how much a business is paying back to its creditors.

As you know, a business won’t be running, let alone functioning for the long run, if it does not have capital.

More essentially, it’s safe to assume that, sometimes, the capital it brings home does not usually come from the company’s own wallet. Before even starting properly, how can it even bring millions? It, generally, cannot. This is where you borrow money from creditors and lenders against the belief that you’ll repay it.

This can widely include banks, financial institutes, and other related sources of borrowed funds. That’s the basic idea of cash flow to creditors. Moreover, understanding the basics of cash flow to creditors is extremely important for any investor, financial enthusiast, or business owner. That is because it is not only about understanding how much debt the business has but also how well it has been managing and paying it back.

That’s what shows whether the financial health of the company is plummeting or gradually evolving. But, there is more to this phrase than this.

Let’s dive in.

Understanding Cash Flow to Creditors

There is no doubt that you would definitely need capital to run the internal and external operations of your business. Most businesses often take help from external sources to fund their operations and activities.

But, in the meantime, after a certain period of time – you need to credit back the amount you took. On a whole, this is the very concept of cash flow to creditors.

Cash Flow to Creditors (CFC), is a very imperative metric that helps financial analysts and investors analyze a company’s financial health and its direct ability to tackle its debt. It is about how much money a business pays to its creditors, which also includes paying back loans and interest. Essentially, this is the sum that leaves the business to settle a debt.

What's your company’s financial health like?

Get free evaluation by our expert accountants.

Now, when we say “creditors”, they are typically people or places, such as the bank or some suppliers, that a business owes money to. As said above, most companies “borrow” a sum to run their businesses, and that sum usually comes from these entities. That said, the amount of interest varies from one lender to another and often also depends on how credible a company is.

More often than not, investors usually rely on this information to understand whether they should invest in the business. Let’s say the company has not been managing its debt well for quite some time. What do you think future investors will do? They are more likely to refrain from investing in it, typically due to their fear of the business’s inability to sustain operations and manage operating expenses in the long term.

That brings us to the next question, how do people calculate it? To understand that, we need to look at its formula. Thus, let’s not sit anymore and discuss the cash flow to creditors equation.

Formula and Calculation of Cash Flow to Creditors

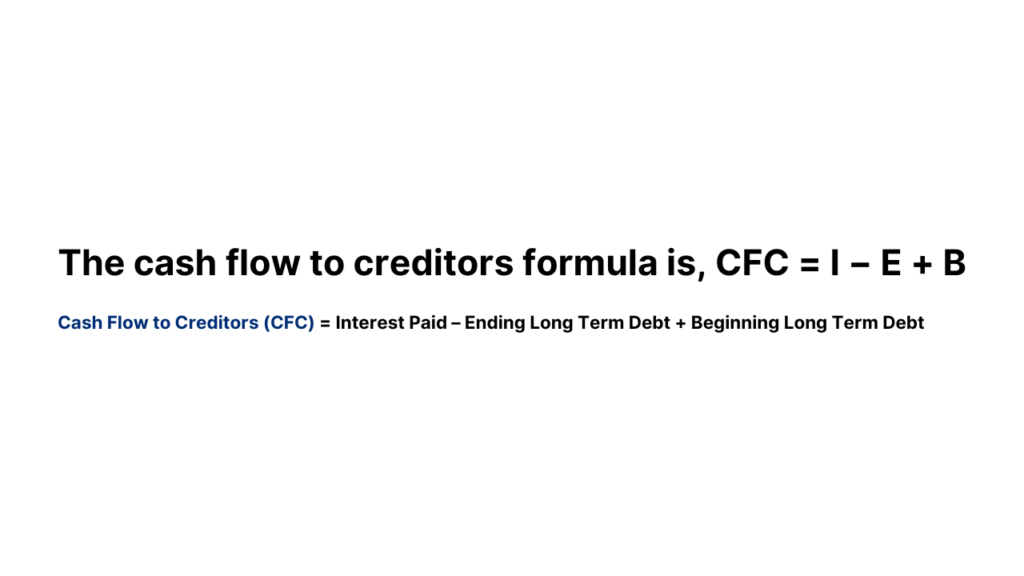

The cash flow to creditors formula is, CFC = I − E + B.

When elaborated, it looks like:

Cash Flow to Creditors (CFC) = Interest Paid – Ending Long Term Debt + Beginning Long Term Debt.

Many people also like to call it the “cash flow to debt holders equation.”

People typically use the cash flow to creditors (CFC) formula to assess a company’s income quality. Furthermore, it is also often called the “statement of cash flows” and helps to measure the sum flowing to debt holders, ultimately allowing a proper cash flow projection.

Many use this formula to manage several minor to major accounting challenges associated with cash flows. But, how do we calculate it? Now that we know the formula, let’s not waste time anymore and calculate cash flow to creditors.

Related Articles:

- ADP or QuickBooks Payroll: Which is Better and Why?

- What is bad debt expense and how to estimate it?

- What’s Cost Volume Profit Analysis? Assumptions, Examples, and Calculations

- What is liquidity ratio? Types, calculation and interpretation

- How to Fill Out a W4 for Dummies: An Easy Guide!

- A Detailed Guide to Accounts Receivable Journal Entry with Examples

- What is a GL code and how to automate it?

- All you need to know about sales tax nexus in 2024

- What are 529 Plan Tax Benefits?

- What is a financial audit and how to prepare for it?

- All about Net Income and Gross Income: Formula, Templates, Tips and more

- The CFO’s Ready Reckoner for Credit Risk Management

- What are operating expenses and how to calculate them?

- 24 Burning Questions About EBITDA Answered in 2024

- What is Cash Burn Rate and How to Calculate it?

How to Calculate Cash Flow to Creditors?

Operating cash flow can be evaluated by adding depreciation to income before interest and taxes, minus the taxes. Now, the Cash Flow to Creditors formula exhibits the amount generated from periodic profits, then adjusted for depreciation (which is a non-cash expense) and taxes (that build cash outflow).

That being said, let’s break down the CFC formula in detail to understand it better.

This equation basically stems from the total payments that are made to the business’s creditors. When looked closely, you can see that it starts with the interest paid on the loans that the company has taken.

The next part helps to understand the change in business’s debt over the course of the financial period. In order to achieve this, you need to subtract the final debt from the initial one. What does this disclose? This evaluation shows whether the company has seen an increase or decrease in debt.

A company may be increasing its debt if it has a high cash flow to creditors, which would indicate a negative cash flow. On the other hand, a decline in debt shows that the business is successfully meeting its financial obligations and making enough money to continue operating.

Let’s look at an example to understand the calculation even better.

Let’s assume a company, Inkly Corporations, recently paid up almost $7,200 in interest on its outstanding debt during a certain time period. In addition, they took on a new $15,800 long-term debt. In the meantime, they also managed to pay off some of the existing long-term debts, which then left a beginning balance of $27,037 long-term debt.

Looking at these values, we can now apply them to the cash flow creditors formula. But, before that, let’s see the values in detail:

- The total interest (i) that the company paid is $7,200.

- The ending long-term debt (dE) for the given time period is $15,800.

- The beginning long-term debt (dB) at the very start of the period was $27,037.

Therefore, let’s look at the cash flow to creditors calculation:

Here’s the formula: CFC = i – dE + dB

Plugging in the values, we get:

Hence, CFC = 7200 – 15800 + 27037

→ Thus, CFC = $18,437

Inkly Corporation, thus, has a CFC of $18,437.

Components of Cash Flow to Creditors

Now that you have a clear idea about how to calculate CFC, let’s have a look at its components:

- Interest paid: This is basically the sum a business goes to pay its creditors as the interest on borrowed funds. This basically reflects the cost of using the sum provided by the creditor.

- Principal repayments: This primarily is the payment that is made by the company to lower down the current outstanding balance of the principal amount which they owe to the creditor.

- New borrowings: As the name suggests, this is any type of loan or debt financing the company takes on during the time frame. Although new borrowings raise the total amount of cash the company has available, they are subtracted when figuring out the net outflow of cash to creditors.

Unsure about any of the components of CFC?

Consult our expert accountants for solutions.

Can Cash Flow to Creditors be Negative?

The answer is, yes! Cash flow to creditors can definitely be negative. Let’s make it a little easier for you to understand. When creditors receive less money than what is owed to them, there is a negative cash flow to creditors. This could usually be seen in the form of interest paid or full/partial payment of the principal amount.

Positive vs. Negative Cash Flow to Creditors

As we already discussed, cash flow to creditors is the net sum a company uses to service its debt, and further tackle its future borrowings. On a ground level, if you have to look more closely, the positive and negative signs of it can reveal a lot of things. Without further ado, let’s clarify what we mean.

Positive Cash Flow to Creditors:

- This is typically a green flag in itself. This implies that the company is producing enough cash to fulfill its interest expenses and potentially minimize its debt burden.

- A positive cash flow usually indicates that the company is actually doing well financially. More essentially, it is also meeting its debt obligations as well without really relying on any extra borrowing.

- Investors also view this in a very positive light. To be precise, it can boost their confidence in the business’s ability to manage its debt and also yield better future returns in the near future.

Negative Cash Flow to Creditors:

- Now, this can be an extra layer of red flag for many. It mainly shows that a company is consuming additional borrowing to satisfy its interest expenses and other cash requirements. More often than not, it raises eyebrows and many reconsider its financial stability in the long run.

- A negative cash flow can also mean that the company is struggling to meet its basic obligations to generate enough cash, exposing it to a major risk of defaulting on the debt.

- This can raise concerns among investors, which really isn’t a good sign. Thus, it can lead them to have minimum confidence in the future of the business, affecting its overall capacity to raise capital.

As a result, creditors typically view positive cash flow as a sign of massive health, whereas negative cash flow raises red flags. Try our cash flow to creditors calculator to understand where your business stands at the moment.

Cash Flow to Creditors: Importance in Financial Decision- Making

When talking about cash flow to creditors, you also need to understand its importance in decision-making:

- Debt management: Cash flow to creditors can be treated like a symbol that tells us how well a company is managing its debt. It is one of the major indicators that helps investors decide whether they want to further invest in the company or not.

- Interest rates and terms: A business that shows its ability to manage its debts efficiently and repay them just in time can always negotiate better interest rates and repayment terms in the future. In that light, it helps authorities decide that they want to offer them better, more favorable terms.

- Financial planning: This is among the biggest decision factors. Financial forecasting and planning are made easier with an understanding of the cash flow to creditors. Moreover, it helps businesses perform detailed financial forecasting for future capital requirements and potential new investments, among many other areas.

Related Articles:

- Accumulated Depreciation vs. Depreciation Expense: What’s the Difference?

- Balance Sheet Analysis for eCommerce Businesses: Insights, Examples, and Template

- How to Calculate the Cost of Goods Sold?

- The Income Statement Cheat Sheet: Elements, Structure and Analysis

- What is Net Operating Working Capital and How to Calculate it?

- How to Clean Up Accounts Receivable and Increase Collection in 2024?

- How to calculate your gross profit? A quick and easy guide

- How to calculate retained earnings on a balance sheet?

- General Ledger 101: Terms, Types, and Templates for Better Accounting

- 4 Financial Statements for Small Businesses: Preparation, Templates, and Comprehensive Guide

- How to Work Out Retained Earnings?

- What is Financial Leverage Ratio and why is it important for small businesses?

- Catch Up Bookkeeping: A Comprehensive Guide

- What is Accounts Payable? Process, Best Practices, Challenges and More!

- NetSuite CRM Integration

Cash Flow to Creditors Case Study

Assume Sun Electronics Ltd. specializes in top-tier consumer electronics. Very recently, just last year, it wanted to restructure its debt and finance product lines. Let’s look at its financial information:

- Interest paid (I): Throughout the fiscal year, the company paid its creditors $25,000.

- Beginning Debt (B): During the start of the year, its total outstanding debt counted to be $150,000.

- Ending Debt (E): Around the year’s end, the total outstanding debt decreased to $100,000 due to repayments.

Now, we have to evaluate the cash flow to creditors for the company during the fiscal year to assess its debt management.

Let’s plug it into the calculation.

The first step is to introduce the cash flow to creditors formula:

CFC = I – E + B

When we replace the values, this is what we get in return:

→ CFC = $25,000 − $100,000 + $150,000

Therefore, after the calculation, the Cash Flow to Creditors is, CFC = $25,000 − $100,000 + $150,000 = $75,000

Henceforth, the cash flow to creditors for Sun Electronics Ltd. during the given fiscal year is estimated to be $75,000.

For the business, this is major good news. Why? That is because this clearly suggests that in addition to paying all interest due, the business was able to lower its overall debt, which resulted in a positive cash outflow to creditors.

4 Tips for Improving Cash Flow to Creditors

You can, too, improve your cash flow to creditors. Here are some easy-to-digest strategies you should be aware of:

Efficiency in debt management is foremost

- Always focus on repaying the debts that have the highest interest rates in the first go, since that can lower the total interest paid over time.

- In case you wish to, you can always refinance the high-interest loans to ones that have lower rates but better terms. This can help you minimize your outflows every month. Isn’t that quite a major save?

- You may not realize it, but payment scheduling can be highly beneficial for you. In simple words, you can always align debt repayments with your cash flow cycles. By doing this, you can guarantee that you have the funds necessary to pay these kinds of obligations when they are due.

Enhance your cash inflow

- If you want to expedite the collection process, you can issue invoices right after the goods and services are delivered – along with creating business invoices.

- One of the best ways to encourage quicker payments is by offering discounts to consumers who usually pay their dues on time.

- Lower the sum invested in inventory without sacrificing the capacity to satisfy customer demands.

Make sure to manage your costs

- Try to cut down on expenses that are actually not very essential to your business.

- If you want to make sure that your money is efficiently used, then promise yourself a detailed budget and stick to it in order to have control over your expenditures. Download our free budgeting template here.

- Cost management usually comes through streamlining operations that downsize costs but, at the same time, boost productivity.

Revenue diversification is just as important

- You can always reduce your dependency on a single source of income by trying to diversify the revenue streams that you have currently.

- Never forget to explore new markets and industries to understand more customer segments to skyrocket your sales and revenue. Because, just as people say, market expansion is what brings profits.

In Wrapping up

No business in this world wants to fail.

But, do you know why so many of them do?

It is because they are not as vigilant with cash flows as they should be.

In businesses, you need to weigh your inflow against your outflow.

If you want your business to thrive in the long run, you need to manage your debt far too well.

Need help understanding what else is important to gauge the current standpoint of your business? Get in touch with professionals who have cultivated more than 12 years of experience in this field, helping people like you know where they stand.

Don’t delay; talk to the experts now.